Social security rights of foreigners in 10 questions

Labour force, capital and information are increasingly gaining mobility in the world. The activities beyond the frontiers of companies and organizations have also mobilized the workforce. Working or residing in different countries raises many consequences for people. One of these is undoubtedly the social security applications. In this article, we will touch upon 10 questions/answers to the social security rights of foreigners/expats in Türkiye/Turkey.

1. Which legislation holds the social security of foreigners?

The Constitution of the Republic of Türkiye/Turkey is at the beginning of the regulations for foreigners in Turkish legislation. The constitution covers foreigners as well as all Turkish citizens. In this sense, Article 60 of the Constitution, "Everyone has the right to social security." On the other hand, Article 90, "Procedure is according to international treaties have the force of law put into effect. It can not be appealed to the Constitutional Court about the alleged unconstitutionality." These provisions are a general framework for the social security rights of foreigners.

On the other hand, the basic rules of the social security of aliens are determined by Social Security and General Health Insurance Law (law number 5510 ). Law Article 4, "based on the principle of reciprocity, except that the nationality of the country made international social security agreement, employees with service contracts from foreign nationals are considered insured according to paragraph 4/a." According to this general rule, in Turkey, all foreigners who work with employment agreement must be reported to SSI. However, the law using the "based on reciprocity, except for nationals of the country in the international social security agreements made" expression, recognized insurance exemption to foreigners who came from bilateral social security agreements signed countries.

Article 6 of the same law says, "Individuals who are sent to Turkey for a job by or on behalf of an organization established in a foreign country and who document to be subject to social insurance in the foreign country, and among the ones who work in Turkey on his/her name and account the individuals who reside abroad and are subject to the social security legislation of that country" shall not be deemed to be insurance holders.

Implementation details of the insurance of foreigners are located in Social Security Procedures Regulations SSI Circular No. 2011/43.

2. What is the bilateral social security agreement?

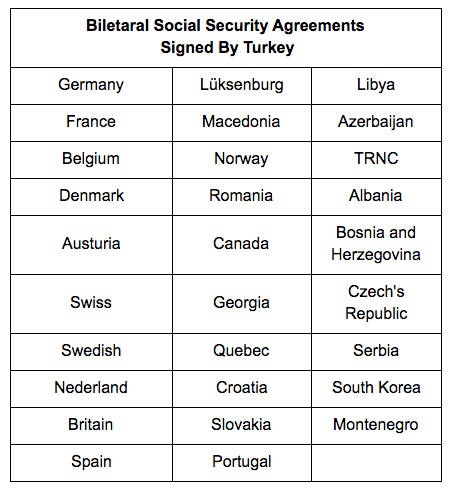

Bilateral or multilateral social security agreements regulate the side of the signatory country nationals' social security rights and their obligations. If a social security agreement between the two countries, this agreement provides many benefits to both countries' citizens. Depending on the scope of the agreement, works in both countries are covered by social insurance. The social insurance right on one side country is also valid on the other. Turkey has signed bilateral social security agreements with these countries.

Labour force, capital and information are increasingly gaining mobility in the world. The activities beyond the frontiers of companies and organizations have also mobilized the workforce. Working or residing in different countries raises many consequences for people. One of these is undoubtedly the social security applications. In this article, we will touch upon 10 questions/answers to the social security rights of foreigners/expats in Türkiye/Turkey.

1. Which legislation holds the social security of foreigners?

The Constitution of the Republic of Türkiye/Turkey is at the beginning of the regulations for foreigners in Turkish legislation. The constitution covers foreigners as well as all Turkish citizens. In this sense, Article 60 of the Constitution, "Everyone has the right to social security." On the other hand, Article 90, "Procedure is according to international treaties have the force of law put into effect. It can not be appealed to the Constitutional Court about the alleged unconstitutionality." These provisions are a general framework for the social security rights of foreigners.

On the other hand, the basic rules of the social security of aliens are determined by Social Security and General Health Insurance Law (law number 5510 ). Law Article 4, "based on the principle of reciprocity, except that the nationality of the country made international social security agreement, employees with service contracts from foreign nationals are considered insured according to paragraph 4/a." According to this general rule, in Turkey, all foreigners who work with employment agreement must be reported to SSI. However, the law using the "based on reciprocity, except for nationals of the country in the international social security agreements made" expression, recognized insurance exemption to foreigners who came from bilateral social security agreements signed countries.

Article 6 of the same law says, "Individuals who are sent to Turkey for a job by or on behalf of an organization established in a foreign country and who document to be subject to social insurance in the foreign country, and among the ones who work in Turkey on his/her name and account the individuals who reside abroad and are subject to the social security legislation of that country" shall not be deemed to be insurance holders.

Implementation details of the insurance of foreigners are located in Social Security Procedures Regulations SSI Circular No. 2011/43.

2. What is the bilateral social security agreement?

Bilateral or multilateral social security agreements regulate the side of the signatory country nationals' social security rights and their obligations. If a social security agreement between the two countries, this agreement provides many benefits to both countries' citizens. Depending on the scope of the agreement, works in both countries are covered by social insurance. The social insurance right on one side country is also valid on the other. Turkey has signed bilateral social security agreements with these countries.

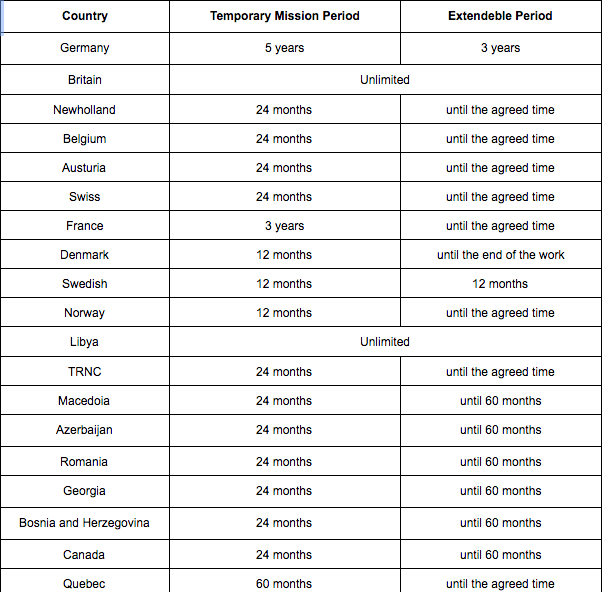

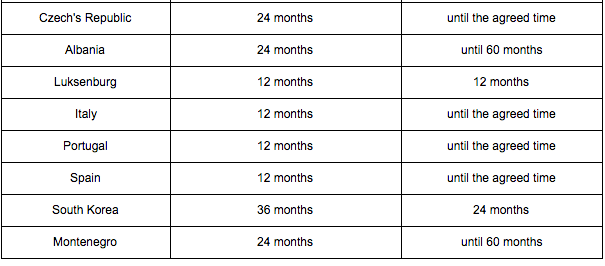

3. Do the bilateral social security agreements affect to foreigners' insurance in Turkey?

Yes, it directly affects. Foreigners who start working in Turkey should be reported to SSI. But individuals who are sent to Turkey for a job by or on behalf of an organization established in a foreign country and who document to be subject to social insurance in the foreign country, and among the ones who work in Turkey on his/her name and account the individuals who reside abroad and are subject to the social security legislation of that country -for the period by the agreement- shall not be deemed to be insurance holders. The aim here is to prevent the same person from being repeatedly insured in both countries. This table shows the temporary mission periods by country according to agreements.

Yes, it directly affects. Foreigners who start working in Turkey should be reported to SSI. But individuals who are sent to Turkey for a job by or on behalf of an organization established in a foreign country and who document to be subject to social insurance in the foreign country, and among the ones who work in Turkey on his/her name and account the individuals who reside abroad and are subject to the social security legislation of that country -for the period by the agreement- shall not be deemed to be insurance holders. The aim here is to prevent the same person from being repeatedly insured in both countries. This table shows the temporary mission periods by country according to agreements.

Foreigners who came to Turkey from countries included in the table above, will not be insured and they will not be reported to SSI even if they work during the temporary duty. A copy of work permission received by foreigners is sent to SSI by the Ministry of Labour and Social Security. These permissions are archived by SSI and waited until the end of the temporary duty period. If foreigners are not reported as insured to SSI at the end of this period, SSI registers them and implements administrative fines on their employers (Circular No. 2011/43). Therefore, after the end of the period included in the table above is required of foreigners SSI statement is.

According to the basic rules of the social security agreements, a person is subject to the social security regime of the country which works. However, persons who are sent to the other contracting country temporarily by the employer, employees of the international shipping business, embassies, consulates, missions and other places working and civilian and military personnel of the sending countries, the contracting parties of the flag on the ships carrying or contracting country port employees, are not subject to social security regime of the country which works. They are subject to the social security regulations of their respective countries.

Example - A person who while working as insured in France sent on temporary duty between April 14, 2019, and April 14, 2022, to Turkey, can demand an extension 3 years from the date April 14, 2022. According to the social security agreement between France and Turkey, he has 6 years (until April 14, 2025) the right to work temporarily without insurance in Turkey.

4. What is the status of foreigners from non-bilateral agreements with Turkey?

The status of foreigners coming to Turkey from a non-bilateral agreement with Turkey is discussed in two parts;

Individuals who are sent to Turkey for a job by or on behalf of an organization established in a non-bilateral country.

Others.

Individuals who are sent to Turkey for a job by or on behalf of an organization established in a non-bilateral country will not be counted as insured during the first three months. To not be considered insured in the first three months, they must certify that they were sent by an organization in their country of origin. After the expiration of the first three-month period, they must be insured in Turkey.

After the expiration date, the employer should report a foreigner who has a work permit and ID number to SSI online. If a foreigner has no ID number, s/he should be reported to SSI with a paper form.

As insured starting date to the insured report form shall be written following the date on which the three-month period expires. however, the employer starting work history as three months expired on the day a different date written notice Differences SSI control and if the day following the necessary procedures will be made after a check by officers inspected.

Example - A foreigner who came from China for temporary duty has received a work permit for the March 16, 2022 and June 16, 2022 period. As s/he documenting the provision of social security in China, s/he not be insured during the first three months. However the end of the three months (date June 16, 2022) the insured recruitment declaration will be given to SSI, and her/his insurance will be launched on June 17, 2022.

5. What is the status of foreigners being in Turkey not sent by an organization in the unsigned agreement country?

For these foreigners, three months exemption is not recognized. If they are working in Turkey as dependent (4/a) or independent (4/b), they should be reported to SSI on the date of start to work.

6. What is the status of those working in embassies and consulates in Turkey?

According to state law and the Vienna Convention, embassies and consulate staff have diplomatic immunity. Therefore, unless employees in these workplaces reported to SSI, the Turkish legislation does not apply to them. However, if these foreigners who work in these workplaces and do not document their insurance from their own countries or third state, they are subject to Turkish law and they can be reported to SSI as dependent insured (4/a).

is a Turkish national in embassies, consulates, missions and similar employees in criminal proceedings is not applied by SSI, and SSI is not notified about them.

If Turkish citizens work in foreign embassies, consulates and similar workplaces and they are not reported to SSI, an administrative monetary penalty is not applied to their employers.

7. Could a foreigner who working without work permission be reported to SSI?

Although the work permit application process and social security are linked to each other, both of them are different legislations. According to Law no. 6735, foreigners could be declared insured to SSI without work permission. In this case, foreigners are registered as insured by SSI. However, after registration, the information about foreigner is shared with the Ministry of Labour and Social Security and the Ministry of Interior.

8. What are sanctions for unreported foreign to SSI?

Located sanctions in the social security legislation in this regard are the same as other Turkish nationals. There is not a special sanction for foreigners in Turkish legislation. About an employer not inform foreign worker to SSI, 20.002 Turkish Liras administrative penalty is applied in 2024. Also in case of the detection work retroactively, a 60.006 Turkish Liras administrative penalty is applied for each month that continued working as uninsured.

9. Is there an obligation to be universal health insured of foreigners?

Mandatory Universal Health Insurance (UHI) system was started in January 1, 2012 in Turkey. Accordingly, there is obligation for everyone covered by the GSS in Turkey. In this sense we can categorized foreigners as follows;

- Dependent employee foreigners and their parents (spouse, child, mother, father): They are entitled to all UHI services after 30 days working in Turkey. Their UHI premiums are paid by employers.

- Self-employed foreigners: They are also entitled to all UHI services after 30 days working in Turkey. Their UHI premiums is paid by themselves.

- Residents in Turkey without working as dependent or independent: Condition to be taken into consideration principle of reciprocity, living permission and non-insured under a foreign country legislation foreigners, in case of a request after the date of one year of the settlement period in Turkey, universal health insured considered from the day following the date of the request. Apply with the complaint will be enough to be insured. As UHI premium is paid 4.800 Turkish Lira per month in 2024.

10. Do foreigners may retire from Türkiye?

Yes, they can. A Turkish citizen retired on which conditions in Türkiye, a foreigner may be retired by fulfilling the same conditions. Since April 30, 2008 to retirement in Turkey;

- Women 58, men 60 years of age must complete,

- Dependent employees 7200 premium days, self-employed and public employees must complete 9000 premium days.

22 January 2024

PhD. Sadettin Orhan

Labor and Social Security Expert

İş ve Sosyal Güvenlik Atölyesi offers counsulting services in labor and social security legislation under coordination of PhD Sadettin Orhan.